Non Probate Affidavit South Dakota – Within thirty days after a loved one’s dying, you can file a Non Probate Affidavit South Dakota for their heirs. The successors may claim real estate, transfer vehicle titles through the DMV, and motor vehicles using this form. For properties under $50,000, this form prevents the need for a probate court proceeding.

Inter vivos trusts in South Dakota bypass probate

An inter vivos trust can be the best option for you if you want your possessions to pass on without going through probate. You can set up one of these trusts during your lifetime, and it will distribute your assets to your beneficiaries after your passing. You have the option of serving as the trust’s trustee while you’re still living or appointing a replacement trustee to serve in that capacity after you pass away. The trustee looks after your assets and makes sure they are dispersed in accordance with your trust’s rules.

In many places, an inter vivos trust can assist in preventing probate. In contrast to a will, this kind of trust enables you to make modifications as you go. Your assets are protected from probate, saving your family time and money. The ability to modify or revoke inter vivos trusts at any time is another advantage.

A year or more can pass during the protracted procedure of probate. Large estates can take longer to settle than smaller estates, which typically take less time. Legal disputes or void wills might potentially lengthen the probate process. Regardless of where you live, you should be aware that the probate process can be time-consuming and difficult for your family and loved ones.

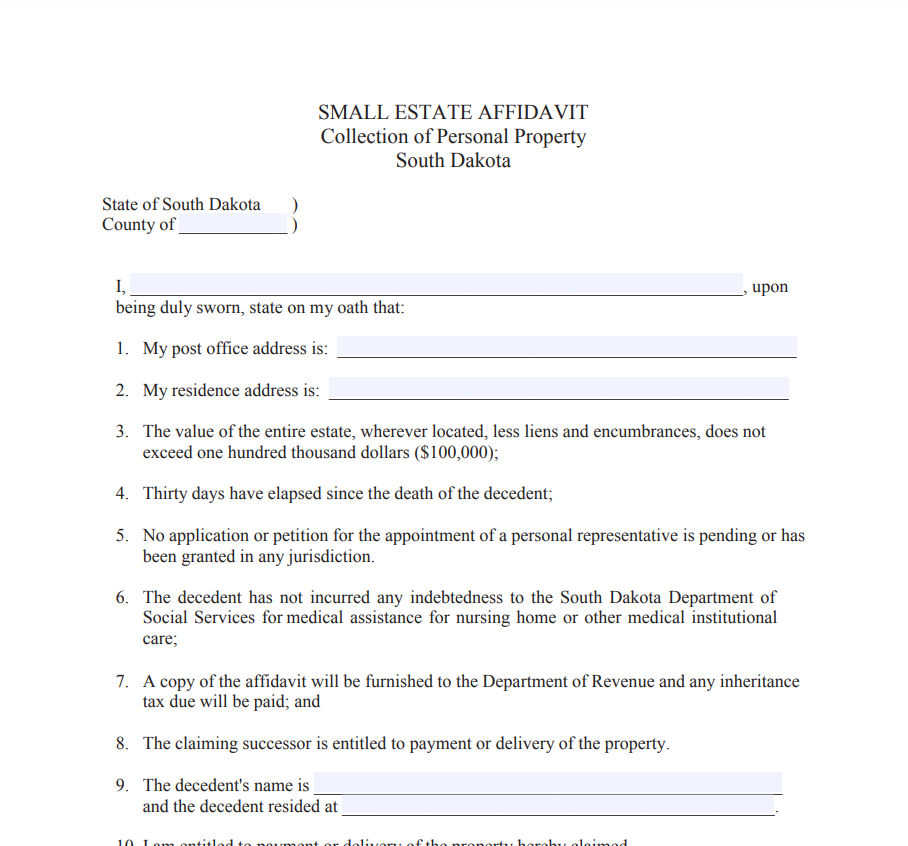

Affidavits for small estates

Avoiding the fees and problems related to probate can be done quite easily by using South Dakota’s small estate non-probate affidavit process. Using the affidavit procedure, you can completely avoid the probate procedure if the value of your estate is less than $50,000.

The laws governing the administration of minor estates are special to South Dakota. These statutes are meant to spare the executor from having to manage a drawn-out, difficult probate procedure. A tiny estate is one that has a total value of $50,000 or less, according to South Dakota law. Heirs can gather and divide assets without going through the formalities of probate court with the help of a small estate affidavit.

A certified copy of the decedent’s death certificate must be presented in order to file a South Dakota small estate non-probate affidavit. For a little cost, you can get these from the state’s health department. The court will start the small estate administration procedure after the affiant files the small estate affidavit. The affiant will thereafter be able to govern the estate and pay out all other beneficiaries’ claims. The assets can then be dispersed in accordance with the decedent’s will or the laws of intestacy after all claims have been paid.

Legal costs related to probate in South Dakota

You can avoid the expenses and delays of probate litigation in South Dakota if your estate is modest and your loved one passes away without leaving a will. However, you must first draft a brief affidavit that is sealed and witnessed. After that, deliver it to the owner of the property. Additionally, you must include the death certificate.

The personal representative will distribute and transfer the remaining assets to the beneficiaries in accordance with South Dakota law if the decedent did not leave a will. The laws regarding estate distribution in the absence of a will are outlined under the state’s intestate succession legislation. In South Dakota, the assets of the deceased person are inherited by the next of kin, or the nearest living relative. It could be a partner or child. The division of the estate will vary depending on the nature of the connection.

In South Dakota, lawyers are allowed to charge for their services. In a simple estate, these costs can range from $40 to $60. Depending on the value of the probate assets, they can also be liable to state probate taxes. The rate of assessment for these taxes is one dollar per thousand dollars of assets. You can pay these costs with a cheque, cash, or credit card. You should be aware that there is a convenience fee of 2% if you pay with a credit card.

South Dakota’s small estate affidavit process

Small estates in South Dakota are permitted to transfer assets without going through probate by using an out-of-court affidavit process. However, there is a 30-day waiting time for this choice. Additionally, the court will confirm that creditors have been compensated.

The Tiny Estate Affidavit procedure is a great choice if you have a small estate and want to bypass the drawn-out, drawn-out process of probate court. Without going through the drawn-out and time-consuming probate court process, it enables you to transfer personal property to your successors. In South Dakota, it is accessible to estates with a value of no more than $50,000. The affiant will take on the responsibilities of the personal representative and be in charge of all matters pertaining to the estate, such as official notices, property distribution, and payment of debts.

You must contact the South Dakota Unified Judicial System to begin the procedure. This will inform you of any active estates in the state as well as any nominated personal representatives. You must provide the form to the person or organization in control of the estate after receiving a copy of it. The affidavit must be signed in front of a notary public.

Download Non Probate Affidavit South Dakota Form 2022