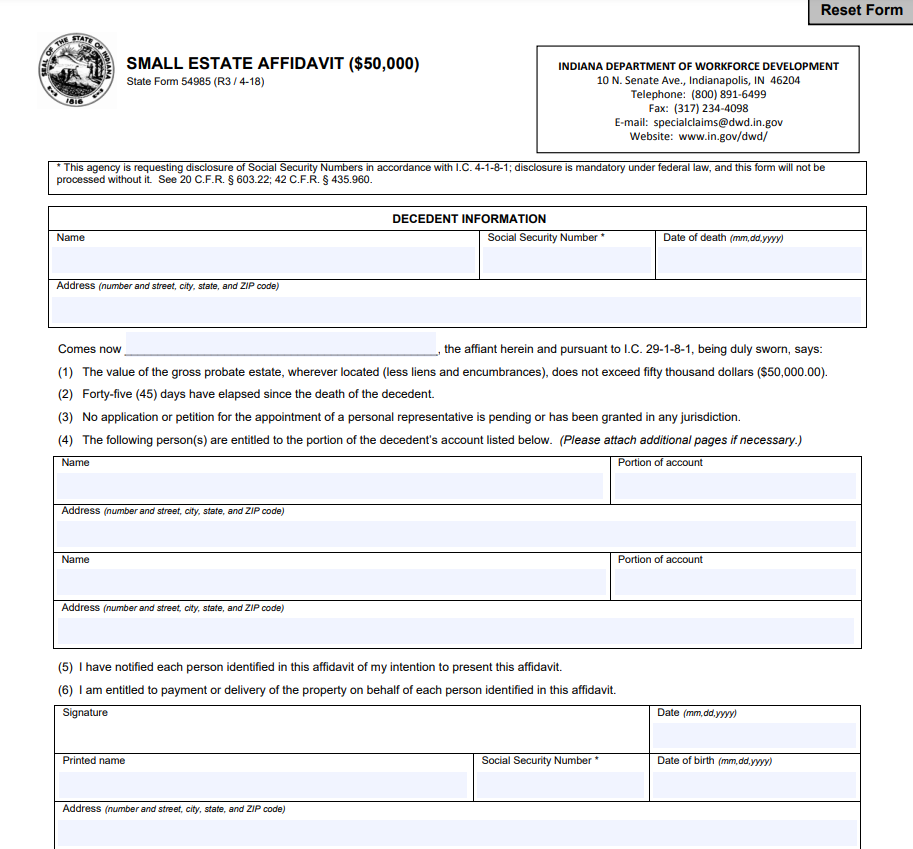

Non Probate Affidavit Indiana – In Indiana, you must provide all relevant details concerning the dead person while drafting a Non Probate Affididavit. Include the decedent’s name, social security number, date of death, and address. You should also mention the name and address of the affiant.

streamlined estate planning

In Indiana, a streamlined estate administration procedure can help you avoid probate if your estate is modest or worth less than $50,000. A beneficiary or heir can transfer their property without going through probate court by using an affidavit. The two can be saved in this way.

Before you can start the procedure, there are a few steps you must follow. Finding out your departed loved one’s assets and debts is the first step. You can start your estate administration after you have those. You must decide who will serve as your personal representative.

The legal process of probate can be drawn out and challenging. The process might take anywhere from six months to a year, depending on the size and complexity of the estate. If there are disagreements or claims made against the estate, the deadline is extended further. Although probate can go on for a while, it is not impossible.

Filing the required documentation is a crucial step in the procedure. A non-probate affidavit form is available from the state of Indiana. The executor must complete the form and submit it to the court if the decedent left a will.

Affidavit for a small estate

The executor may transfer the property in Indiana by filing a Small Estate Affidavit if the value of the decedent’s estate is less than $50,000. A certified copy of the decedent’s death certificate must also be filed with the affidavit, which must be signed in front of a notary public. The local health department is where one can receive the death certificate.

The most typical method of administering an estate is through the legal procedure known as probate. The surviving spouse is given the power to acquire assets, settle debts, pay taxes, and distribute any leftover assets to beneficiaries in this process. A state statute or a will both have the power to accomplish this.

All assets are combined to calculate the estate’s value, which is then reduced by encumbrances. This value is often $50,000 or less, but it may occasionally be less. It is advised to submit a Small Estate Non Probate Affidavit in Indiana in such circumstances.

The executor must list the worth of all assets and debts, including any funeral expenses, when submitting an affidavit. Additionally, small estate affidavits must be notarized in many states, and the notary seal serves as verification of their validity.

revocable living trusts

The use of a living revocable trust is the best way to avoid probate in Indiana. These trusts allow your beneficiaries to decide how to divide up your assets after your death. You designate your successor trustee and give them ownership of your property when you establish one of these trusts. Without going through a probate court, your successor trustee will transfer the asset to the trust beneficiaries.

You must fill out a living trust form in order to transfer assets to the trust. Both Microsoft Word and Open Document Text versions of these forms are accessible online. They need to state whether the trust is a new one or a modification to an existing one, the date the trust was established, and the names of the grantor and trustee. You must also mention the beneficiaries of the trust as well as the assets that will be transferred to it.

Financial institutions will require proof of the trust document if you intend to transfer your assets to the trust. Many financial institutions desire protection and to avoid the responsibility of altering the title to your assets, thus this is important. Fortunately, the financial institutions frequently accept these documents.

Making an estate plan involves using a living revocable trust affidavit Indiana. It enables you to keep your assets free of a probate tax. Currently, this tax costs $1 per thousand dollars. The clerk of court, however, may claim that a piece of property is part of the estate if the trust stipulates that the Personal Representative is permitted to sell it. If this occurs, the Personal Representative may refuse to exercise the option of selling the assets in order to avoid the probate tax.

Download Non Probate Affidavit Indiana Form 2022