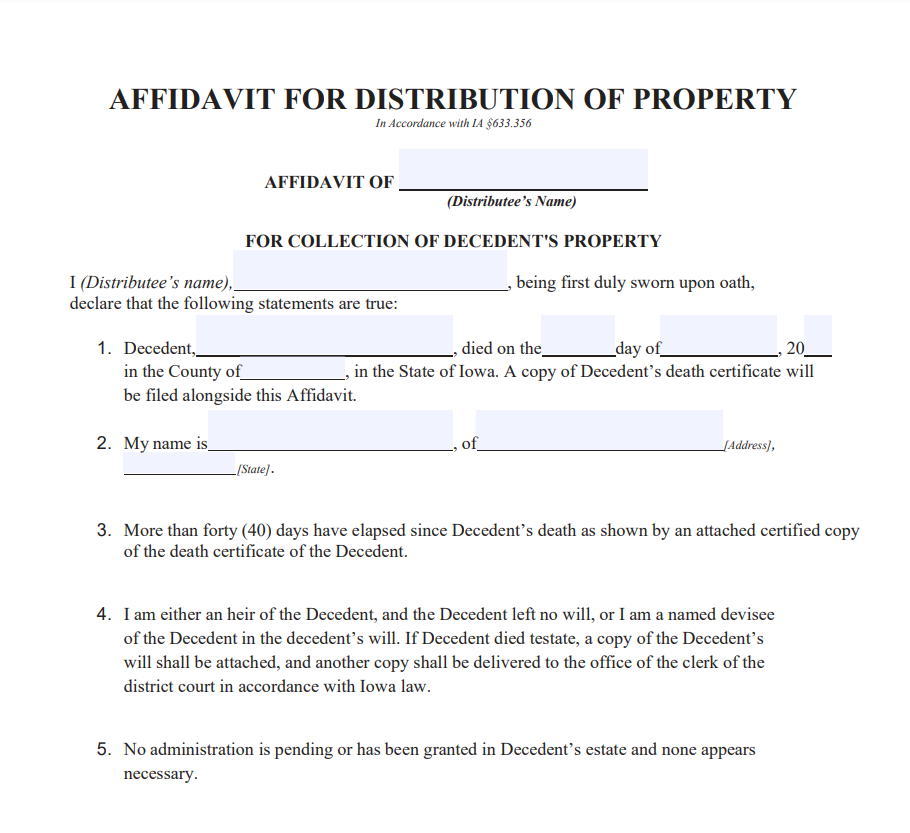

Non Probate Affidavit Iowa – If your estate is not large, you can avoid probate in Iowa. Before claiming an estate, you must wait at least 40 days following the decedent’s passing. Otherwise, the estate will be subject to collection efforts and the probate procedure. People in these circumstances should consider using a Non Probate Affidavit.

tiny estates

In Iowa, small estates do not need to go through the probate process in order to distribute the decedent’s assets. The executor can circumvent the formalities of the standard probate process by filing a short affidavit with the local probate court, which is how the state of Iowa has simplified the probate process for minor estates.

Intestate estates are those in which the decedent failed to leave a valid will, according to Iowan law. The court chooses an executor or personal representative in certain situations. The surviving spouse must file an affidavit of surviving spouse with the clerk of court in the county where the real estate is located if the dead did not leave a will.

In Iowa, the affidavit is crucial for tiny estates. The effectiveness of the process depends on how much personal property the decedent owned. The executor cannot transfer the estate to a new owner without this document. Confusion and delays in the transfer of assets may result from this. It is crucial to finish the affidavit application process as soon as possible in order to prevent these issues.

The procedure may appear to be confusing. It can be expensive and time-consuming, even with a modest estate. You can navigate the legal minefield if you have an estate planning counsel on your side. If your estate is eligible for a small estate affidavit, your lawyer will be able to give you advice on that matter.

Exempt assets

In Iowa, you can transfer property without going through the probate court by using a Non Probate Affidavit. This form is used to give title to real estate owned by a deceased person to their beneficiaries. Personal property can also be transferred via it. The affidavit and a copy of the decedent’s death certificate must be delivered to the organization holding the decedent’s property.

The Iowa inheritance tax is not applied to the estate of a decedent who passes away before July 1, 2016. The estate of the surviving spouse, parents, grandparents, and great-grandparents is also included in this. The state’s inheritance tax, however, is imposed on the estate of a decedent who passes away after this date.

This document must be filed in the county where the deceased resided by the executor of the estate. The legal description of the deceased person’s property must be included in this document. Additionally, it must specify that the deceased’s assets are free from Iowa’s inheritance tax. A copy of the document must be stored by the estate’s beneficiary for future use.

A streamlined probate procedure can be employed to settle a decedent’s estate if it is not very large. Even in cases where there was no will, this procedure still applies. The estate must be valued at less than $25,000 to be eligible for this streamlined probate process. By submitting a petition to the court, the estate administrator can start the procedure.

substitute for probate

Iowa has a legal option that can assist you if you have a small estate and want to transfer property to heirs without using the probate court system. Even for tiny estates, going through the probate court process might take a while. The procedure might be significantly sped up using an Alternative to Probate Affidavit, though.

Another approach to avoid probate in Iowa is using a revocable living trust. You must identify all of your assets, including any life insurance policies or retirement accounts, when you establish a revocable living trust. Additionally, you can designate beneficiaries on assets like bank accounts and payable-on-death designations.

You do not have to go through probate if you and your spouse are joint tenants in a property. You can file an affidavit of the surviving spouse after your spouse passes away to avoid paying inheritance tax. The court in the county where the real estate is situated must receive this paperwork. To avoid paying inheritance tax if you have joint tenants, you must go through the probate procedure.

The probate procedure in Iowa is comparable to that in many other states. It does, however, differ in several ways, such as the standards and timescales. As a result, you should speak with a lawyer to determine whether the Iowa process is the best option for you.

Download Non Probate Affidavit Iowa Form 2022