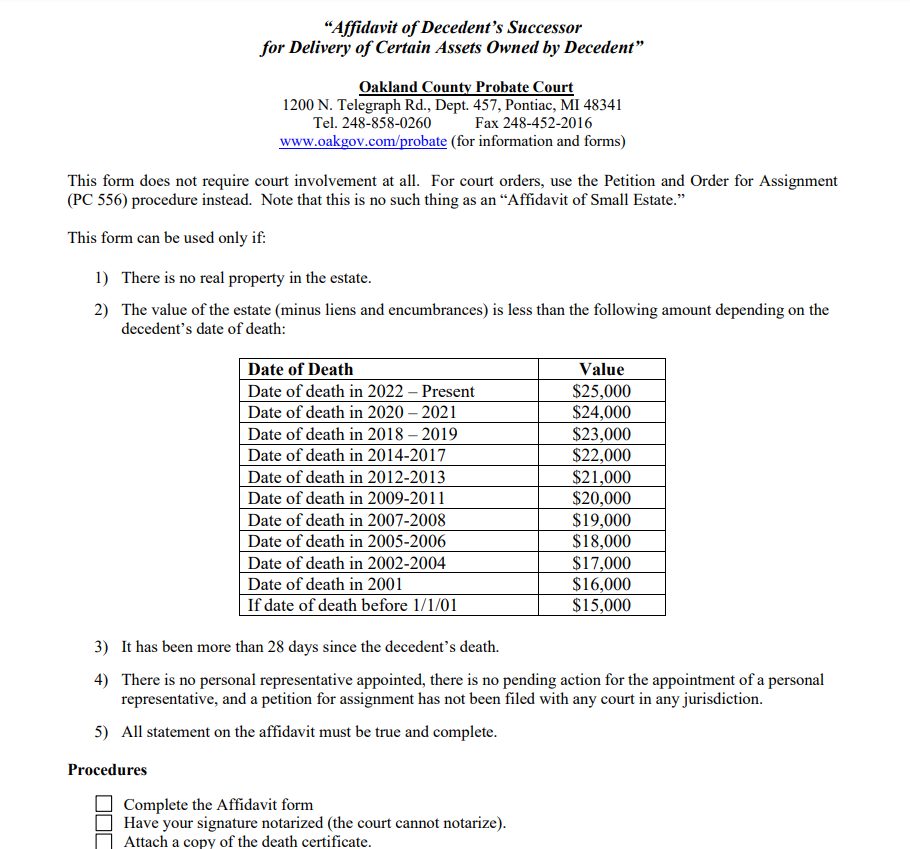

Non Probate Affidavit Michigan – If a decedent died without leaving a will, a legal document called the Non Probate Affidovit Michigan needs to be filed. If an estate is liable to estate tax, this paperwork is necessary. The estate tax deduction amount varies according to the size of the estate, but in Michigan, the law caps it at $24,000. The estate’s assets must also be fully described, together with their valuation and any liens that might affect them, by the decedent’s successors.

Assignment of Real Estate

Depending on the type of property being assigned, there are various methods that can be used. For instance, the surviving spouse in a decedent’s estate could be able to totally escape the probate procedure. The surviving spouse may also be entitled to certain benefits under Michigan law. However, state law may impose additional obligations on other successors. This obligation, in some circumstances, may last for up to 63 days from the date the assets were assigned.

In Michigan, a non-probate affidavit can be used to handle the administration of minor estates. Large estates worth more than $25,000 cannot be handled via this procedure, though. The owner of the asset must fill out a small estate affidavit form in order to employ this approach. The state court has the form on hand.

When a person passes away and leaves behind a tiny estate, the assignment of property procedure is utilized. For modest properties, this approach is sufficient. It necessitates having knowledge of all assets, the heirs, and the amount spent on funeral expenses. If there are multiple heirs, a lawyer should be contacted.

laws governing modest estates

The probate procedure in Michigan is made easier by the laws governing minor estates. Processes can be streamlined to save a drawn-out and expensive court battle if the estate’s value is under $15,000 and there are only a few items. These tiny estates can frequently be resolved without the need for a court’s intervention utilizing a straightforward affidavit.

Dealing with the deceased person’s wages is one part of the Michigan probate process for small estates. As an illustration, if a deceased individual had a contract with their employer, the employer would be responsible for paying the estate’s beneficiary. The contract may have specified how pay would be dispersed following the decedent’s passing.

Any out-of-state assets that the decedent had must be included on the Michigan estate inventory form.

The procedure for submitting an affidavit of asset transfer

The procedure of filing an affidavit is a crucial stage in the process if you intend to transfer an asset from one person to another. Within 45 days following the property transfer, an affidavit must be submitted to the local assessor’s office in Michigan. Following filing, the assessor will change the property’s taxable value for the year following the transfer. Transfers to family members are also tax-free if the property isn’t put to use for commercial gain.

A small estate probate procedure is another approach to transfer assets. The estate of the deceased person doesn’t have to go through a court hearing in this kind of probate process. A death certificate and an affidavit to the property owner are all that are needed. This procedure can be utilized to transfer property if the estate’s worth is under $24,000.

Within 45 days of the transfer of ownership, the transferee must submit an affidavit to the local assessor in order to transfer real estate. To ensure that the property is fairly assessed and that the taxable value is accurate, this is required. Penalties for filing documents late are $5 per day.

The procedure for obtaining funds owed to you by a deceased person’s employer

It is possible to collect money owed from a deceased person’s employer without a judge’s help. There may be a policy or agreement between the employer and the deceased employee that details how the deceased’s salary should be distributed to a surviving spouse or children. If they hadn’t, they could have provided written directions. These instructions should tell the employer to pay the decedent’s spouse or children the surviving spouse’s earnings and benefits.

Unlike the procedure employed in estate administration, this one is distinct. The death may not be disclosed to the heirs. If the heirs weren’t a spouse or a child under 18, they can still be accountable for the debt. For instance, if the deceased’s sibling received an inheritance of $1,000, he might be responsible for $500 of the debt.

The process must be undertaken if the deceased person possessed any real estate. In other circumstances, it may be applied even if the dead possessed no real estate. A probate judge will nonetheless review the procedure in this instance. You need to be aware of the deceased’s assets, heirs, and burial costs in order to use this approach. You must be the heir or the person who covered the cost of the burial.

Download Non Probate Affidavit Michigan Form 2022