Non Probate Affidavit New Hampshire – The Non Probate Affididavit is a legal document that skips probate procedures and gives control of a deceased person’s assets to their remaining owners after their death. There are numerous uses for this paper. It can be used to bank accounts that have a beneficiary set up at the time of death, life insurance policies, retirement accounts, certificates of deposit, and investment products, for instance. It may also serve to cover the executor of an estate’s time and costs in particular situations.

Administration in brief

The summary administration procedure may be used in New Hampshire to settle an estate without having to go through the probate court system. If there are no debts or other encumbrances on the estate, this is possible. In the event of a debt, the amount to be paid as well as the conditions and restrictions of the debt’s payment must be stated in a summary administration affidavit.

Many states offer streamlined probate processes for small estates. With no need for a court hearing, this enables heirs to secure the release of their assets. To get this order, an heir may need to submit a petition to the court in some states, though. Once the court grants the petition, the heirs often only need to take this action once and are excused from further court appearances.

If a person is the only inheritor and they are confident that there are no unpaid bills or unresolved claims against the estate, they may submit an application for a summary administration in New Hampshire. Additionally required is a certificate from the department of revenue administration. A request for summary administration can also be made by an heir without submitting a formal estate inventory or accounting.

NHJB-2145-Pe form

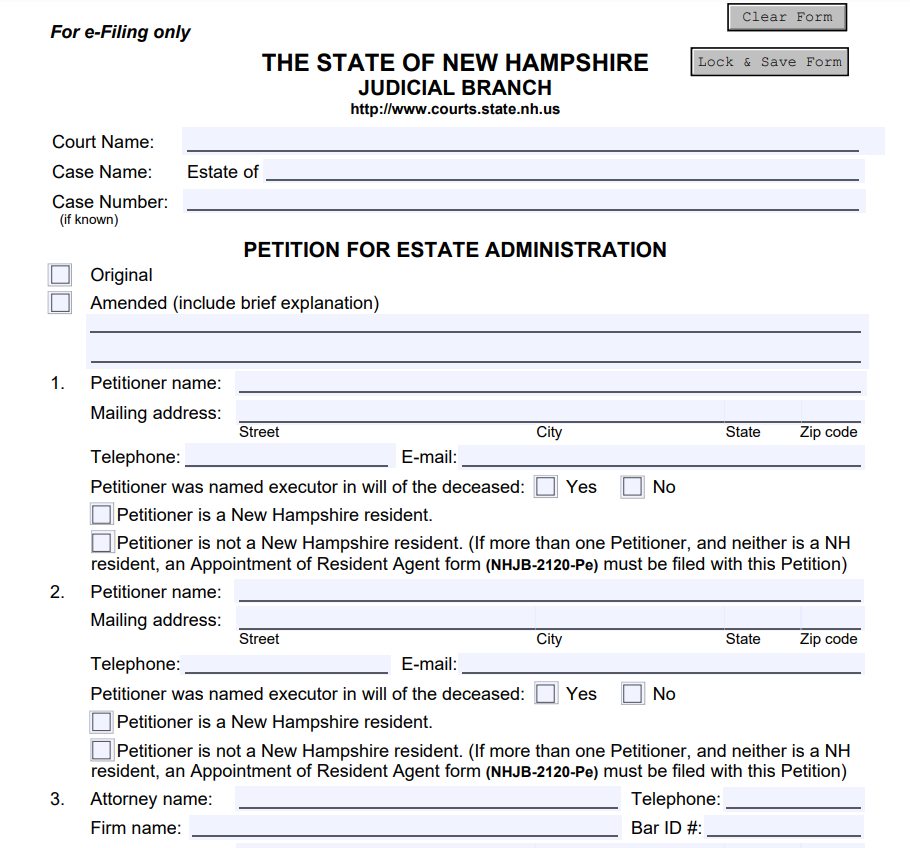

The NHJB-2145-P Form A legal document known as a Non Probate Affididavit New Hampshire asks the court to name a personal representative and/or executor for a decedent’s estate. The probate court in the county where the deceased person resided must get a copy of this form. This form can be filed electronically in some cases.

Most people draft a final will and testament, however some people choose not to. In these circumstances, the family may file a Petition for Estate Administration, which initiates a case in New Hampshire’s probate court system. With the aid of this document, a bereaved family can sell and distribute the deceased person’s belongings without the help of an attorney. The form is typically employed in small estates, or those valued at less than $100,000, in New Hampshire.

Please double-check the petitioner’s name, phone number, complete mailing address, and zip code before submitting the form. Include the information of any other petitioners, if any. If the deceased person was an attorney, you should also include their name, contact information, and Bar ID number. Include the deceased person’s name, date of death, and last known address in your final paragraph.

Conditions for filing

Before submitting a non-probate affididavit in New Hampshire, a number of conditions must be satisfied. The affidavit shall be in writing and shall be signed by the individual making the affidavit and by two reliable witnesses.

But there are some exceptions. The absence of an estate tax in New Hampshire is the first. Only after someone passes away is this tax levied on their heirs. Although the federal gift tax is in effect if a person transfers $16,000 or more in a year, the state does not apply a gift tax. Additionally, there are no pay or salary taxes in New Hampshire. However, interest and dividends are subject to a 5% tax. In addition, property taxes are hefty.

The affiant must sign the non-probate affiDavit and include their contact information, including a phone number and mailing address. Additionally, a Notary’s seal and credentials must be provided. A court must also approve the affidavit.

Timeline

It takes some planning to submit a Non Probate Affididavit in New Hampshire. The procedure include alerting all relevant organizations and parties, such as the Department of Health Services and the Social Security Agency. A court hearing might be arranged, depending on the circumstances. Additionally, you’ll need to collect evidence to back up your allegation. This procedure is pricey. There are other charges associated, such as legal fees, personal representative fees, and court expenses. Although the estate often pays for these expenses, they can be rather costly. For this reason, a lot of people look for alternatives to the probate system.

Download Non Probate Affidavit New Hampshire Form 2022