Non Probate Affidavit Oregon – In Oregon, a Non Probate Affidavit is used to inform governmental organizations of the probate of an estate, including the health plan and department of human services. Although this is addressed especially to certain entities, it performs the same function as a public notification. This is crucial because the estate could be held liable if the deceased was receiving public aid.

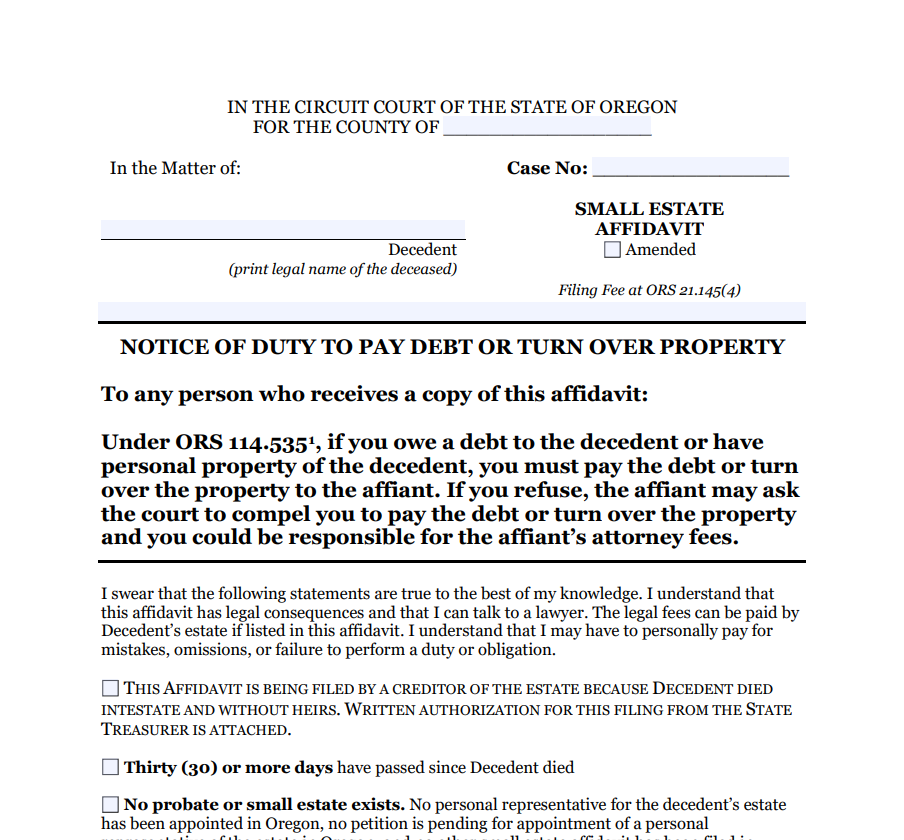

Notice of Obligation in Non-Probate Affidavit to Pay Debt or Turn Over Property

You can submit a Notice of Obligation to Pay Debt Affidavit if your loved one has died and you are unable to pay his or her debts. This document can be used to notify creditors of a debtor’s claim against the estate of your loved one as well as to recover debts from the estate. An affidavit often has to state all outstanding obligations together with their known or projected amounts. Along with their names and addresses, unpaid debtors should be listed. A copy of the affidavit must also be delivered to each creditor, as stated in the affidavit.

The affidavit details the affiant’s duties to recover the debt and deliver the property. Additionally, it specifies the possibility of receiving attorney fees if the affiant prevails. A personal representative in full probate may use the affidavit as a legal document to gather assets and debts.

Fee for filing

You must include information about who owns what property on the SEA form in Oregon. Additionally, it requests the last known name and address of any creditors. The quantity and kind of claim they might have must also be mentioned. Additionally, the paper needs to be notarized. This document normally requires a filing fee of $15 to $20.

Oregon probate typically takes four months to complete and costs around $3,000 to do so. For more sophisticated estates or those with a large number of heirs, this figure may be considerably higher. Fortunately, for tiny estates, there are alternatives to probate. For families with less than $275,000 in assets, the small estate affidavit in Oregon, for instance, is a fantastic choice. You can transfer assets to your heirs using this approach without having to pay for probate.

For a cost of roughly $20, the non-probate affidavit can be filed online in Oregon. For this procedure, there are three possibilities. The first is to utilize a professional service that offers help and is reasonably priced.

You must include details on the deceased person’s will, heirs, and residence. You must also deliver copies to the state taxing authority. The state needs this information in order to collect state taxes. If the deceased was receiving government assistance, you might also need to provide an affidavit. The government might demand payment in this situation for the aid it gave.

Conditions for filing

You need to be aware of the requirements if you wish to submit a non-probate affidavit in Oregon. You must deliver a legally binding will as well as other crucial details about the deceased to the state. You must also offer details regarding the heirs and their relationship to the deceased. The deceased person’s home address must also be included in the affidavit.

The Personal Representative is required by the state of Oregon to inform both the department of human services and the Oregon health plan. Similar to placing the notice in the newspaper, however with this one the government agencies are the target. The notice is required because government organizations might file a claim against the estate if the deceased owing money for public assistance.

For small estates, Oregon also offers a streamlined probate procedure. Beneficiaries may transfer assets to others without going through the court system thanks to this accelerated method. The estate would be eligible for this alternative procedure if it had a value of less than $275,000. The amount of the estate will determine whether or not this process will save time and money.

If a deceased person produced a will in Oregon prior to passing away, they must present a certified copy of it. The affidavit must be accompanied by a certified copy of the will if it was delivered outside of Oregon. Each heir must also be named and put on the form separately, along with their present address.

Download Non Probate Affidavit Oregon Form 2022