Non Probate Affidavit Virginia – According to Virginia law, anyone with a stake in real estate may submit a Non Probate Affididavit. The individual filing the document does not have to be the personal representative of the estate if the decedent passed away intestate. However, if the deceased person had a will, they were not able to use this option.

Documentation is necessary.

In order to file a Non Probate Affidavit in Virginia, one must first ascertain the estate’s valuation. They must then provide a list of the decedent’s assets together with an estimate of the value of any real estate and personal goods to which they are solely entitled. The form must then be signed by them.

When the beneficiary of a deceased individual wants to obtain the assets without the estate going through probate, a notarized affidavit is utilized. It is crucial to remember that using an affidavit does not exempt the successor from their fiduciary obligations. Thus, the Successor shall make early payment of all Debts. A petition must be filed with the Virginia Probate Court by the successor if the estate’s worth is less than $25,000.

The documentation that the personal representative needs

Virginia law stipulates what must be included in a non-probate affidavit regarding the decedent’s assets. This is due to the fact that the personal representative is in charge of paying debts, allocating assets to beneficiaries, and submitting all required documentation about the estate administration procedure. If there are insufficient assets to cover the debts, the personal representative must make payments according to the Virginia legal hierarchy. If there are sufficient assets, the decedent’s wishes and any intestacy laws must be followed in distributing the remaining assets.

It is necessary to compile an inventory of the decedent’s estate, which must detail the total value of all assets as of the moment of death. The assets must be valued accurately in accordance with Virginia law. The personal representative is also required to submit the final federal and state income tax returns. Depending on the revenue the estate received, the personal representative may also be required to file fiduciary income tax filings.

tiny estates

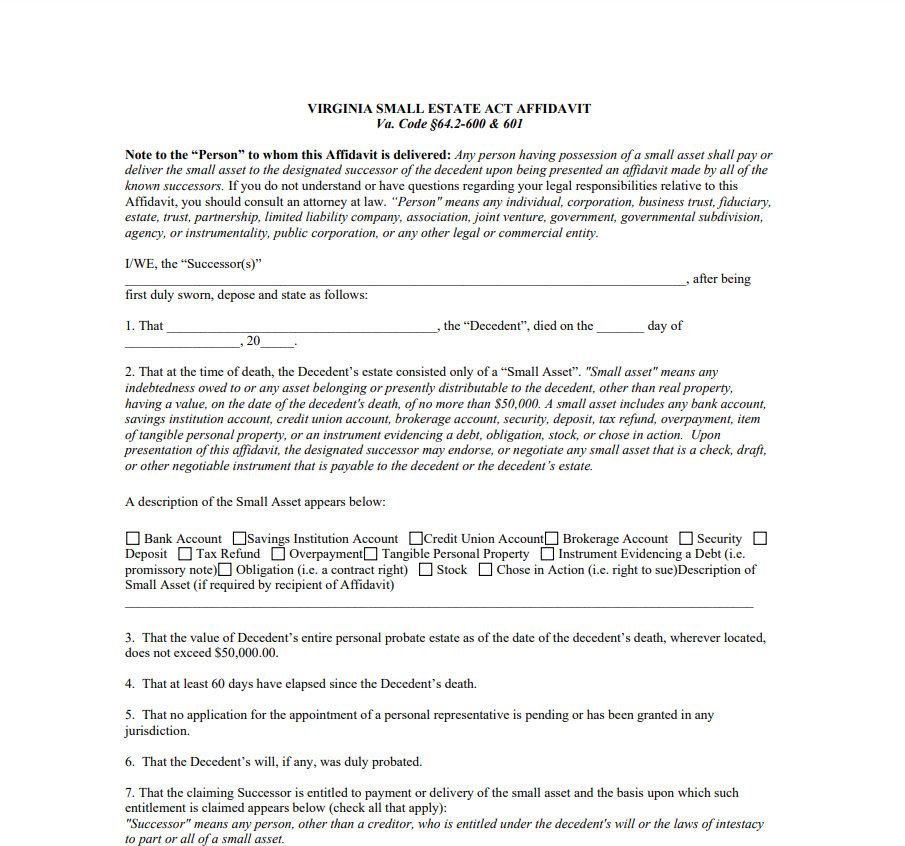

When a person passes away in Virginia without leaving a will, a legal instrument called the Non Probate Affidat Virginia for modest estates is utilized to skip the probate procedure. Use of this affidavit is advised if the estate’s personal property value is less than $50,000. An affidavit can be signed in front of a notary public, unlike a will, which must be submitted to the probate court.

You must first calculate the worth of your estate in order to obtain a Non Probate Affidat Virginia for small estates. Examining the combined value of all the assets in your estate will help you with this. You can move on with the non-probate process without a personal representative’s assistance if the value of your estate is less than $50,000. As the fiduciary of the estate, it is your responsibility to look after it and distribute the remaining assets to your beneficiaries.

Heirs-at-law

You might be able to avoid probate if your deceased loved one left behind a little estate by submitting a Non Probate Affidation. The successors to the estate will be listed in this document. The surviving spouse or children may accept the decedent’s possessions through these successors.

Make a full list of your heirs before dying away if you have a complicated family. When it’s time to divide the assets, this will make the process go as smoothly as possible. Additionally, make sure all the paperwork is in order to prevent any delays in the transfer of your assets.

the day of death

For modest estates, Virginia offers a number of shortcuts that simplify the probate process. By using these short cuts, survivors can transfer property swiftly and effectively while avoiding the probate process’s costs and delays. Nevertheless, there are some situations where taking a short route leaves probate necessary.

The passing date must be mentioned in non-probate affidavits. An affidavit might not always be required for a small estate. A notarized affidavit can be used to reclaim assets from third parties, businesses, or financial institutions, albeit, if the estate’s value isn’t over $25,000. A Virginia Code SS 64.2-602 may let someone to recover assets worth less than $25k without filing a formal affidavit. However, this cannot be used until sixty days have passed since the decedent’s passing. The petitioner also needs to sign it and provide the Successor’s name in the petition.

Affidavit for a small estate

You can bypass probate court by using a Small Estate Affidavit from Virginia. These papers, also known as “Small Estate Act Affidavits,” are used to transfer ownership of modest assets without appointing a personal representative or filing a lawsuit. For instance, a fiduciary can transfer the assets without having to file an affidavit if the estate’s value is less than $25,000. The person receiving the asset is referred to as a “fiduciary” and has a responsibility to safeguard it, settle the decedent’s debts, and transfer the remaining funds to the decedent’s heirs.

Virginia’s procedure is comparable to a modest estate in Utah. According to Virginia law, small estates with a value of less than $25k can disperse their assets to a successor without the necessity for an affidavit. However, the executor cannot utilize a small estate affidavit if the estate involves real estate.

Download Non Probate Affidavit Virginia Form 2022