Small Estate Affidavit Form California – The Small Estate Affidavit filing process is a necessary and simple task. You will have the ability to immediately enter your loved one’s property thanks to this paperwork. When submitting this form, there are a number of factors to bear in mind, including its restrictions and exclusions.

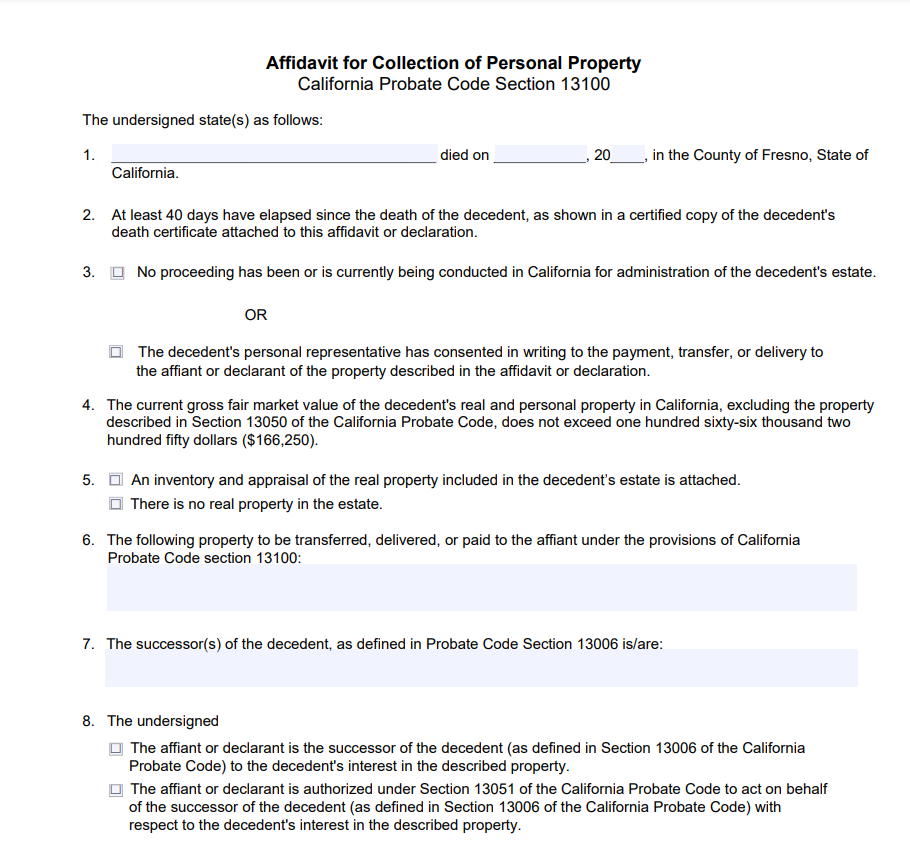

Type DE-310

An legal document known as the California Small Estate Affidavit must be submitted in order to administer an estate with a value of less than $150,000. It is only used to transfer personal goods and does not transfer title to real estate. It needs to be notarized and include the components listed in the California probate code. A probate referee must also sign an inventory and appraisal form.

The heirs of a deceased individual typically fill out this little estate affidavit form and hand it to the person in charge of the property. Although the value of the estate must be sufficiently low, in some states the heirs must additionally submit an affidavit to the court.

When inheriting property from a deceased person, a person must complete the California Small Estate Affidavit, a legal document. It must to be submitted within 40 days of the death. This document is intended to make sure the heirs are entitled to their inheritance if the deceased person did not leave a will. A circuit court or surrogate’s court may be the proper local court to file the document in once it is finished.

Limits

A tiny estate affidavit is a legal document that avoids the probate process when transferring a deceased person’s possessions. Beneficiaries may experience difficulties during the lengthy and expensive probate process. The procedure is quick and easy with a small estate affidavit, and neither an appraisal nor a bond are necessary. It is frequently submitted without the assistance of a notary public. The 13100 declaration is the small estate affidavit form that is utilized the most frequently.

This kind of affidavit needs to be submitted 40 days following the decedent’s passing. Although it might need to be notarized, it is not necessary to file it with the court. Although real estate cannot be transferred using this form, it is frequently helpful when a decedent had assets spread across several financial institutions.

Depending on how much property is involved, the California Small Estate Affidavit’s restrictions change. Only real estate worth $55,425 or less can be used in the affidavit process. The Small Estate Affidavid method can be the best option if the value of a deceased person’s estate is less than this. It will avoid the need for formal probate and be less expensive.

Exclusions

You can be eligible for the Small Estate Affidavit form in California if you’re giving tangible personal property to a new owner. It is an efficient and practical method for transferring your assets. Affidavit procedures are much quicker than full probate procedures, which in California might take seven to 18 months to complete.

Small estates are those with assets valued at less than $184,500. These estates are often not complicated and are not often in dispute. Simply stating that you are entitled to particular assets is all that a minor estate affidavit will do. The person or organization holding the asset will hand it over to you after receiving the affidavit.

The small estate affidavit form has a number of exclusions in California. First off, it’s crucial to understand that a small estate affidavit is only applicable to estates with a value of less than $184,500. It’s crucial to remember that title companies could not accept a small estate affidavit.

Procedure

A modest estate affidavit form can give surviving family members rapid access to their loved one’s assets and is quite easy to fill out. Additionally, this form will not need to go through the probate administration process, which can take up to six months to finish.

A small estate affidavit form must be submitted to ensure that the surviving family members can receive the estate when someone passes away without leaving a will. It must specify the deceased’s time of death and detail all of their possessions. The form must also be submitted within a certain amount of time following the decedent’s passing.

Real estate held under shared tenancy is one of the situations when the small estate affidavit form does not apply. Bank accounts with many beneficiaries and those that are payable on death are a couple of additional exceptions. Contracts for life insurance may also not be included in the calculation. Additionally, it is not essential to modify the title of the car if the deceased individual donated the majority of their assets to a trust. In this situation, a small estate affidavit form in California can assist in avoiding probate.

Download Small Estate Affidavit Form California 2022